Through its Wealth Management division, Goldberg Capital Partners offers multi-family office services to support its clients in managing their assets, according to the renowned Swiss private banking, which rests on reliability, confidentiality, transparency and professional discipline.

The client is at the centre of the advisory process and directs every decision: the task of Goldberg Capital Partners is to provide an overview, helping the client understand the most complex scenarios, define objectives and priorities and identify the best strategies and most effective solutions.

Goldberg Capital Partners acts exclusively in the interest of its own clients in an independent manner. By relying on a team of professionals with over thirty years of experience in the financial Industry, it is a trusted partner for the management of private assets.

TAILOR-MADE MANAGEMENT

With a view to maintaining the purchasing power of the assets of its clients and future generations, Goldberg Capital Partners develops state-of-the-art customised investment strategies that can satisfy even the most complex needs.

Based on a risk profile and benchmarks that are discussed and shared with the client, Goldberg Capital Partners offers advisory and non-discretionary portfolio management services that allow the client to be involved in the decision-making process.

Thanks to an independent management system and an open architecture, the Goldberg team provides highly customized management and advisory services to its clients, in line with their financial goals and risk profile for a solid and steady asset growth.

- Adoption of models designed to maximize the risk/reward ratio with a fee system that encourages the achievement of goals and good performance.

- The choice of the depository bank is up to the client based on the bank’s financial strength, service efficiency and cost analysis.

PRIVATE DEBT AND UNCORRELATED INVESTMENT MANAGEMENT

Goldberg Capital Partners specializes in asset management models that invest in private debt instruments, with a risk/reward ratio that is significantly more efficient compared to traditional fixed income strategies.

This type of highly diversified portfolio management is characterized by a high degree of uncorrelation and low volatility.

- Thorough due diligence-driven asset class selection.

- High degree of investment protection afforded by underlying guarantees

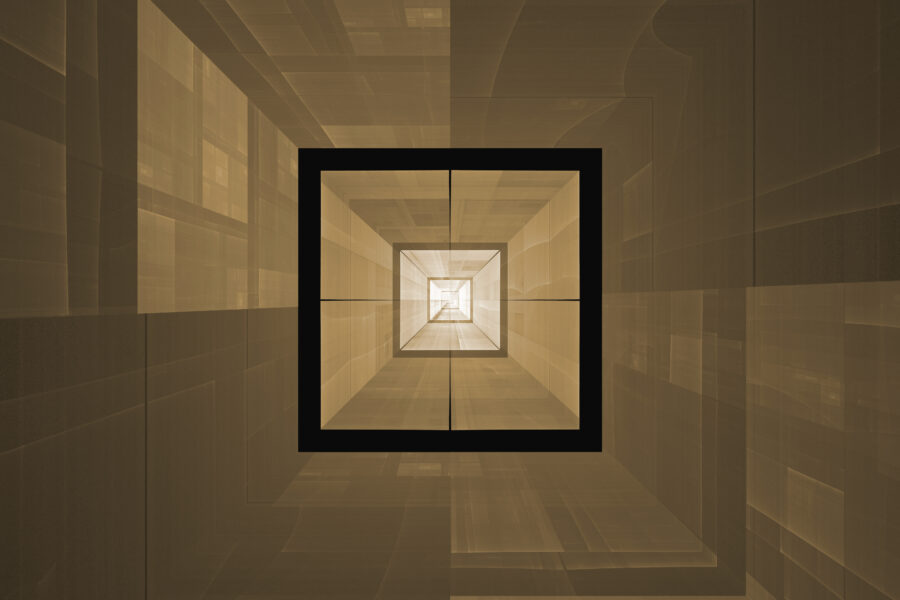

Waldstein Art Consulting

Goldberg partecipa al capitale di Waldstein Art Consulting, si propone come Art Advisor di supporto sia a clientela privata che istituzionale, in particolare agli operatori del mercato finanziario che riconoscono l’arte come un importante asset patrimoniale e necessitano di un supporto specialistico per i propri clienti, al fine di offrire servizi eccellenti e indipendenti dai player tradizionali.

WEALTH PLANNING

In a context of growing internationalization, fast-paced global changes and complex family situations, Wealth Planning services include all solutions that can allow family assets to rest on a structure that is both tax-efficient and capable of protecting and maintaining such assets over time. With the support of its team of legal advisors and the aid of international tax law experts, Goldberg Capital Partners helps its clients in all matters of family governance.

RELOCATION SERVICES

Transferring one’s residence abroad has become an increasingly common need that can have tax-related consequences. When relocating abroad, Goldberg Capital Partners can provide valuable support to its clients in evaluating family and business implications related to changes of residence by:

- Analysing and evaluating tax-related impact

- Discharging bureaucratic and administrative formalities

- Fulfilling disclosure obligations

ADVANTAGES

- Regular reviews of investment goals and strategies

- Customized asset management according to the client’s objectives

- Optimized investment risk through broad diversification

- Regular detailed reports on portfolio management

- Consolidated portfolio reporting

- Transparent and shared investment decision-making processes

- Favourable or competitive bank pricing